고급 IRB

Advanced IRB| 은행규정 및기준 |

|---|

| 배경 |

| 필러 1: 규제자본 |

| 필러 2: 감독 검토 |

| 3번 필러: 시장 공개 |

| 비즈니스 및 경제 포털 |

Advanced IRB(고급 IRB) 또는 A-IRB(Advanced IRB)라는 용어는 고급 내부등급 기반 접근법의 약어로, 은행기관에 대한 바젤Ⅱ 자본적정성 규칙에 따라 제안된 일련의 신용위험 측정 기법을 가리킨다.

이러한 접근법에 따라 은행들은 신용위험에 필요한 자본을 계량화하는 자체 경험적 모형을 개발할 수 있다. 은행은 현지 감독기관의 승인에 따라서만 이 접근법을 사용할 수 있다.

A-IRB에 따르면 은행들은 자체 정량적 모델을 사용하여 PD(채무불이행 확률), EAD(채무불이행 노출), LGD(채무불이행 손실) 및 RWA(위험가중자산) 계산에 필요한 기타 파라미터를 추정해야 한다. 그리고 총 소요 자본은 추정 RWA의 고정 백분율로 계산된다.

Some formulae in internal-ratings-based approach

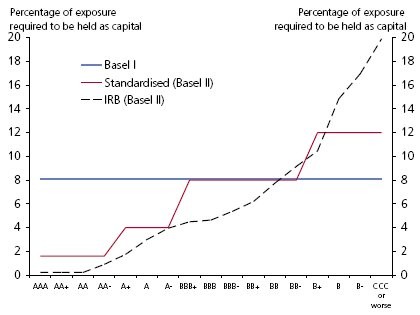

Some credit assessments in standardised approach refer to unrated assessment. Basel II also encourages banks to initiate internal ratings-based approach for measuring credit risks. Banks are expected to be more capable of adopting more sophisticated techniques in credit risk management.

Banks can determine their own estimation for some components of risk measure: the probability of default (PD), loss given default (LGD), exposure at default (EAD) and effective maturity (M). For public companies, default probabilities are commonly estimated using either the "structural model" of credit risk proposed by Robert Merton (1974) or reduced form models like the Jarrow-Turnbull model. For retail and unlisted company exposures, default probabilities are estimated using credit scoring or logistic regression, both of which are closely linked to the reduced form approach.

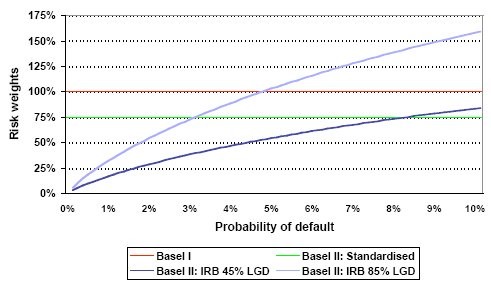

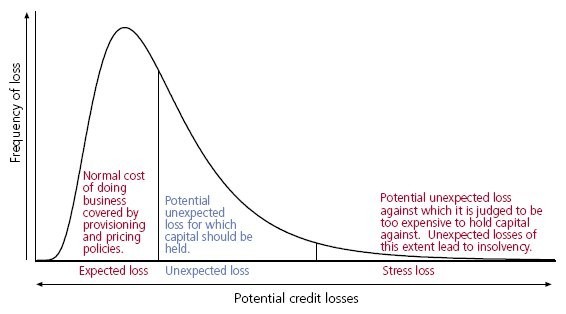

The goal is to define risk weights by determining the cut-off points between and within areas of the expected loss (EL) and the unexpected loss (UL), where the regulatory capital should be held, in the probability of default. Then, the risk weights for individual exposures are calculated based on the function provided by Basel II.

Below are the formulae for some banks’ major products: corporate, small-medium enterprise (SME), residential mortgage and qualifying revolving retail exposure. S being Min(Max(Sales Turnover,5),50 )

In the formulas below,

- N(x) denotes the normal cumulative distribution function

- G(z) denotes the inverse cumulative distribution function

- PD is the probability of default

- LGD is the loss given default

- EAD is the exposure at default

- M is the effective maturity

Corporate Exposure

The exposure for corporate loans is calculated as follows[1]

Correlation

- AVC[2] (Asset Value Correlation) was introduced by the Basel III Framework, and is applied as following :

- if the company is a large regulated financial institution (total asset equal or greater to US $100 billion) or an unregulated financial institution regardless of size

- else

Maturity adjustment

Capital requirement

Risk-weighted assets

Corporate exposure adjustment for SME

For small and medium enterprises with annual Sales Turnover below 50 million euro, the correlation may be adjusted as follows:[3]

Correlation

In the above formula, S is the enterprise's annual sales turnover in millions of euro.

Residential mortgage exposure

The exposure related to residential mortgages can be calculated as this[4]

Correlation

Capital Requirement

Risk-weighted assets

Qualifying revolving retail exposure (credit card product)

The exposure related to unsecured retail credit products can be calculated as follows:[5][6]

Correlation

Capital Requirement

Risk-weighted assets

Other retail exposure

All other retail exposures are calculated as follows:[7]

Correlation

Capital Requirement

Risk-weighted assets

The advantages

- Basel-II benefits customers with lower probability of default.

- Basel-II benefits banks to hold lower capital requirement as having corporate customers with lower probability of default (Graph 1).

- Basel-II benefits SME customers to be treated differently from corporates.

- Basel-II benefits banks to hold lower capital requirement as having credit card product customers with lower probability of default (Graph 2).

External links

- http://www.bis.org/publ/bcbsca.htm Basel II: Revised international capital framework (BCBS)

- http://www.bis.org/publ/bcbs107.htm Basel II: International Convergence of Capital Measurement and Capital Standards: a Revised Framework (BCBS)

- http://www.bis.org/publ/bcbs118.htm Basel II: International Convergence of Capital Measurement and Capital Standards: a Revised Framework (BCBS) (November 2005 Revision)

- http://www.bis.org/publ/bcbs128.pdf Basel II: International Convergence of Capital Measurement and Capital Standards: a Revised Framework, Comprehensive Version (BCBS) (June 2006 Revision)

- http://www.bis.org/publ/bcbs189.pdf Basel III : A global regulatory framework for more resilient banks and banking systems (BCBS) (June 2011 Revision)

References

- ^ Basel II: International Convergence of Capital Measurement and Capital Standards: a Revised Framework (BCBS) (November 2005 Revision), Paragraph 272

- ^ Basel III : A global regulatory framework for more resilient banks and banking systems (BCBS) (June 2011 Revision), Paragraph 102

- ^ Basel II: 자본 측정과 자본 표준의 국제 융합: 개정된 프레임워크 (BCBS) (2005년 11월 개정), 문단 273

- ^ Basel II: 자본 측정과 자본 표준의 국제 융합: 개정된 프레임워크 (BCBS) (2005년 11월 개정), 단락 328

- ^ Basel II: 자본 측정과 자본 표준의 국제 융합: 개정된 프레임워크 (BCBS) (2005년 11월 개정), 문단 329

- ^ "CRE31 - IRB approach: risk weight functions". www.bis.org. 2020-01-01. Retrieved 2020-08-27.

- ^ "CRE31 - IRB approach: risk weight functions". www.bis.org. 2020-01-01. Retrieved 2020-08-27.

- Duffie, Darrell and Kenneth J. Singleton (2003). Credit Risk: Pricing, Measurement, and Management. Princeton University Press.

- Lando, David (2004). Credit Risk Modeling: Theory and Applications. Princeton University Press. ISBN 978-0-691-08929-4.

![{\displaystyle K=LGD\cdot \left[N\left({\sqrt {\frac {1}{1-R}}}\cdot G(PD)+{\sqrt {\frac {R}{1-R}}}\cdot G(0.999)\right)-PD\right]\cdot {\frac {1+(M-2.5)b}{1-1.5b}}}](https://wikimedia.org/api/rest_v1/media/math/render/svg/1b78e360c829144f01f9efb94697dad7ca9ca01e)

![{\displaystyle K=LGD\cdot \left[N\left({\sqrt {\frac {1}{1-R}}}\cdot G(PD)+{\sqrt {\frac {R}{1-R}}}\cdot G(0.999)\right)-PD\right]}](https://wikimedia.org/api/rest_v1/media/math/render/svg/8a140b8ed1d875483f2e2fc59135e1eaf6aba73c)